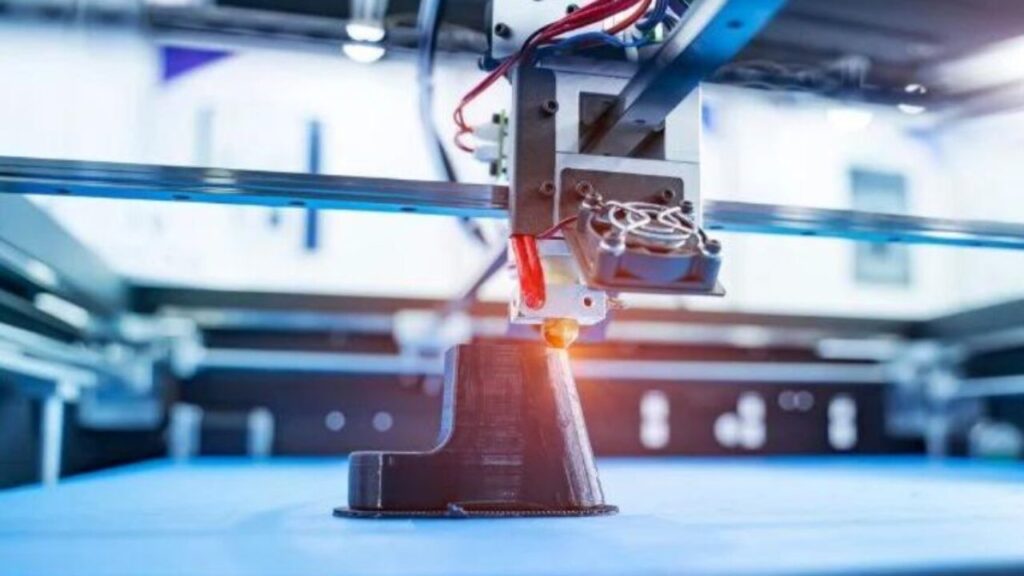

3D printing, also known as additive manufacturing, has transformed industries worldwide. It allows businesses to create complex designs efficiently, saving both time and resources. As this technology advances, 3D printing stocks are becoming an exciting opportunity for investors. If you’re curious about this booming industry, this guide will help you navigate the market.

What is 3D Printing?

3D printing is a process of creating objects layer by layer using materials like plastic, metal, or resin. It’s different from traditional manufacturing, which involves cutting or molding materials. This unique approach reduces waste and enables intricate designs.

The technology first gained popularity in prototyping. Companies used it to create models of their products before moving to full production. Today, 3D printing is widely used for mass production in sectors like healthcare, aerospace, and consumer goods.

One of the most exciting aspects of 3D printing is its versatility. It’s used to make everything from medical implants to custom car parts. This flexibility makes it a valuable tool for many industries, driving the growth of the 3D printing market.

The market is also expanding rapidly. According to recent reports, it’s expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This makes investing in 3D printing stocks an appealing choice for those looking to diversify their portfolio.

Why Should You Invest in 3D Printing Stocks?

1. A Growing Market

The 3D printing industry is one of the fastest-growing sectors in technology. With businesses adopting this innovation across industries, demand for 3D printing solutions is skyrocketing. Investing now means entering a market poised for substantial growth.

2. Innovation Drives Opportunities

Companies in the 3D printing sector are constantly innovating. They’re developing faster printers, better materials, and more efficient software. These advancements improve the value of their products, giving them a competitive edge.

3. Diverse Applications

One reason 3D printing is so valuable is its wide range of applications. In healthcare, doctors use it to create personalized implants. In aerospace, manufacturers produce lightweight parts for airplanes. These diverse uses ensure that the industry remains relevant.

4. Strong Market Potential

Analysts predict that the global 3D printing market will reach $50 billion by 2030. Such a significant valuation means companies in this space have immense potential for growth, making them attractive for long-term investors.

5. Eco-Friendly Technology

As sustainability becomes a global priority, 3D printing companies are focusing on green manufacturing. The technology produces less waste than traditional methods and uses energy more efficiently. This appeals to environmentally conscious businesses and investors.

Top 3D Printing Stocks to Watch in 2025

Investors looking to tap into the potential of 3D printing stocks should focus on companies driving innovation and capturing market share. Below are some of the leading players in the sector.

1. Stratasys (SSYS)

Stratasys is a pioneer in the 3D printing industry, known for its high-performance printers and diverse range of materials. The company caters to industries such as automotive, healthcare, and aerospace, making it a versatile player.

One of Stratasys’ key strengths lies in its focus on innovation. They recently launched advanced printers capable of producing intricate designs with exceptional precision. Their consistent R&D investments position them as leaders in the industry.

Moreover, Stratasys has strong partnerships with major corporations, boosting its revenue streams. These collaborations ensure the company remains at the forefront of the market, making its stock appealing to long-term investors.

2. 3D Systems (DDD)

3D Systems has been a dominant force in the additive manufacturing market for years. Its comprehensive product lineup includes printers, software, and materials, making it a one-stop shop for 3D printing solutions.

The company is heavily focused on expanding its presence in the healthcare sector. From dental solutions to surgical planning tools, 3D Systems leverages its technology to transform patient care. This focus on a high-growth sector enhances its stock’s potential.

Additionally, 3D Systems is investing in metal printing technologies. This move is particularly attractive for industries like aerospace and automotive, where metal parts are in high demand.

3. Desktop Metal (DM)

Desktop Metal is an emerging player gaining significant traction in the 3D printing market. Known for its innovative metal printing solutions, the company aims to make industrial-grade 3D printing accessible to businesses of all sizes.

What sets Desktop Metal apart is its commitment to scalability. The company’s systems are designed for high-volume production, a critical factor for industries looking to adopt additive manufacturing at scale.

Desktop Metal’s partnerships with major manufacturers have also bolstered its reputation. These collaborations highlight its potential to grow in the competitive 3D printing landscape.

Factors to Consider Before Investing in 3D Printing Stocks

1. Financial Stability

Before investing, evaluate a company’s financial health. Look for strong revenue growth, manageable debt levels, and positive cash flow. Companies with stable finances are better positioned to weather economic uncertainties.

2. Market Position

The competitive landscape of 3D printing is constantly evolving. Invest in companies with a proven track record of innovation and a strong customer base. Market leaders are more likely to maintain their edge over competitors.

3. Sector Focus

Different companies focus on different industries. Some specialize in healthcare, while others target aerospace or consumer goods. Choose stocks aligned with sectors experiencing robust growth.

4. R&D Investments

Innovation is crucial in the 3D printing industry. Companies that consistently invest in research and development are more likely to stay ahead of the curve and deliver long-term returns.

5. Industry Trends

Keep an eye on trends such as sustainability, metal printing, and software integration. Companies leveraging these trends are likely to experience higher demand for their products.

Future Trends in 3D Printing

1. Growth in Healthcare Applications

The healthcare sector is one of the biggest beneficiaries of 3D printing. From customized prosthetics to bioprinting human tissues, the possibilities are endless. Companies focused on this area are poised for tremendous growth.

2. Increased Adoption in Manufacturing

Traditional manufacturing processes are being supplemented or replaced by additive manufacturing. This shift allows companies to produce parts faster and at a lower cost, driving demand for 3D printing solutions.

3. Sustainability Initiatives

As the world focuses on reducing waste, 3D printing’s eco-friendly processes make it an attractive option. Companies emphasizing green technologies will likely gain favor among investors.

4. Advancements in Metal Printing

Metal printing is one of the fastest-growing segments of the industry. It’s especially popular in aerospace and automotive sectors, where strong, lightweight components are essential.

5. Cloud-Based Solutions

The integration of cloud computing with 3D printing software is transforming the industry. Cloud-based solutions allow businesses to streamline design processes and improve collaboration.

Conclusion: Is 3D Printing Worth the Investment?

Investing in 3D printing stocks offers an opportunity to be part of a revolutionary industry. With its diverse applications, rapid innovation, and strong growth potential, the market shows no signs of slowing down.

However, as with any investment, due diligence is crucial. Research the financial stability and market position of companies before making decisions. By staying informed and focusing on long-term potential, you can make the most of this exciting opportunity.